What to Know

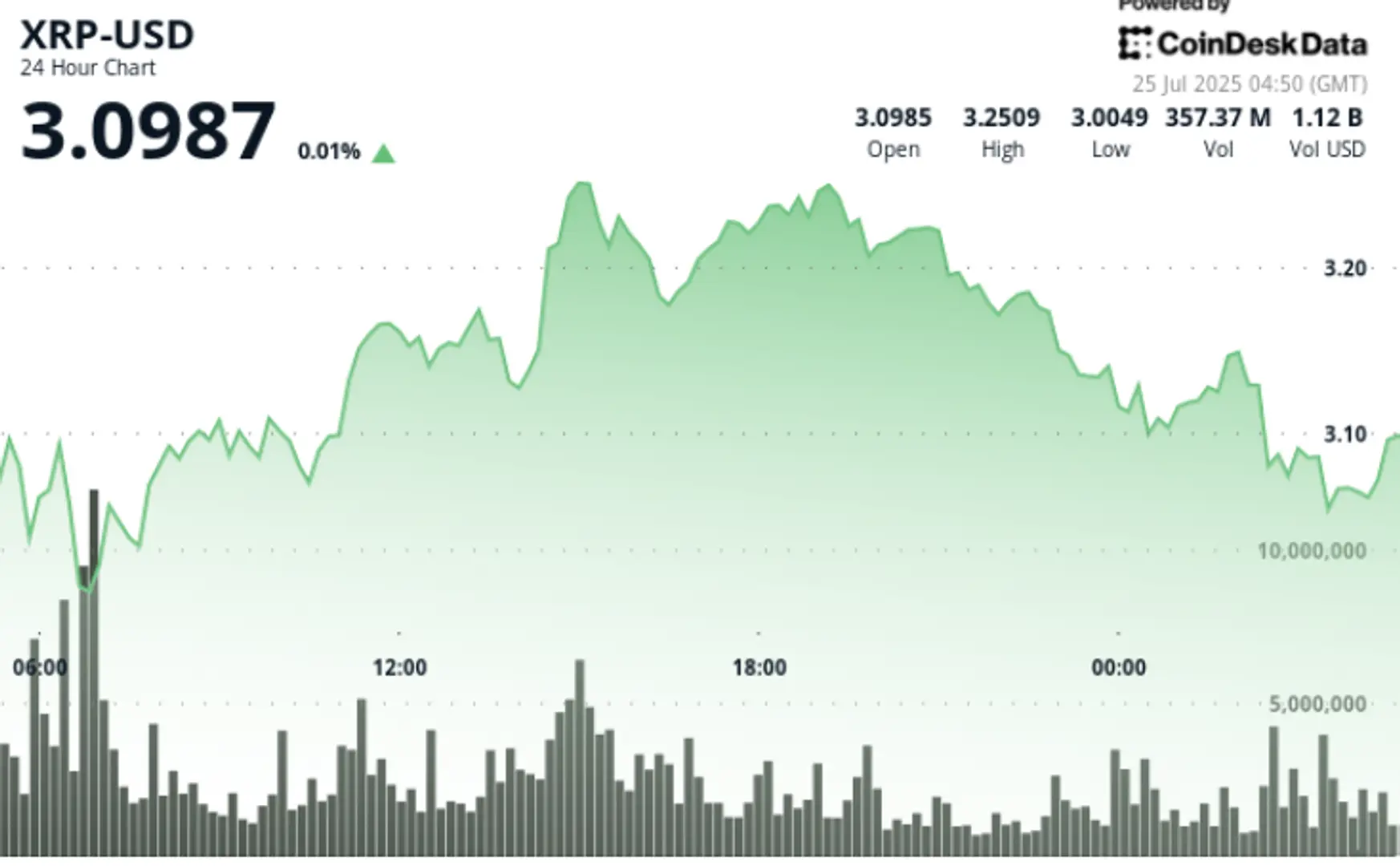

XRP posted sharp losses during the July 24–25 session, dropping 8% as the token traded in a $0.30 range from $2.96 to $3.26.

An early session rally fizzled after profit-taking intensified near the resistance level, while a sudden liquidation wave wiped out more than $100 million in long positions.

Despite the selloff, key support at $3.06–$3.10 held through repeated tests, with late-session price action showing signs of potential stabilization.

Nature’s Miracle and Brazil’s VERT made headlines with new XRP-based strategies, but institutional sellers dominated the tape amid fears that ETF approvals may face delays.

News Background

📖 Related Reading

- 📰 Crypto Daybook Americas: Institutions Pile In Amid ‘High Conviction’ That Prices Will Grind Higher

- 📰 AAVE Breaks Key Resistance as DeFi Sector Heats Up

• XRP traded in a 7.85% range between $2.96 and $3.26 over 24 hours starting July 24 at 05:00.

• Coinglass data showed over $18 billion in total crypto liquidations during the session.

• XRP long liquidations topped $105 million, contributing to rapid declines.

• Nature’s Miracle announced a $20 million XRP treasury plan.

• Brazil-based VERT deployed a $130 million blockchain solution built on the XRP Ledger.

Price Action Summary

The session opened at $3.13 and saw a sharp drop to $2.96, followed by a bounce to a $3.26 high at 15:00 on 175.94 million volume — more than double the average. However, resistance at $3.24–$3.26 capped gains. Price collapsed again late in the session, dropping to $3.05 during the 03:00–04:00 window on a 6.2 million volume spike, likely due to forced selling or liquidation flows. XRP recovered modestly to close at $3.08.

Technical Analysis

• Trading range of $0.30 between $2.96 low and $3.26 high.

• Heavy resistance confirmed at $3.24–$3.26 after rejection post 15:00 rally.

• Critical support at $3.06–$3.10 tested repeatedly with volume-backed bounces.

• Final hour shows breakdown to $3.05 before reclaiming $3.08 — a possible bullish reversal signal.

• Liquidation-driven volatility suggests increased risk, but firm bid zones offer short-term structure.

What Traders Are Watching

• Whether XRP can hold the $3.06–$3.10 zone into the next session.

• Impact of further ETF-related developments from U.S. regulators.

• Signs of institutional reentry or renewed retail participation above $3.15.

• Broader crypto market stability following multi-billion-dollar liquidations.

🔗 You Might Also Be Interested In

Crypto Daybook Americas: Institutions Pile In Amid ‘High Conviction’ That Prices Will Grind Higher

AAVE Breaks Key Resistance as DeFi Sector Heats Up

Asia Morning Briefing: Risk of Escalating Israel-Iran Conflict Keeps BTC Around 105K Says QCP

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!