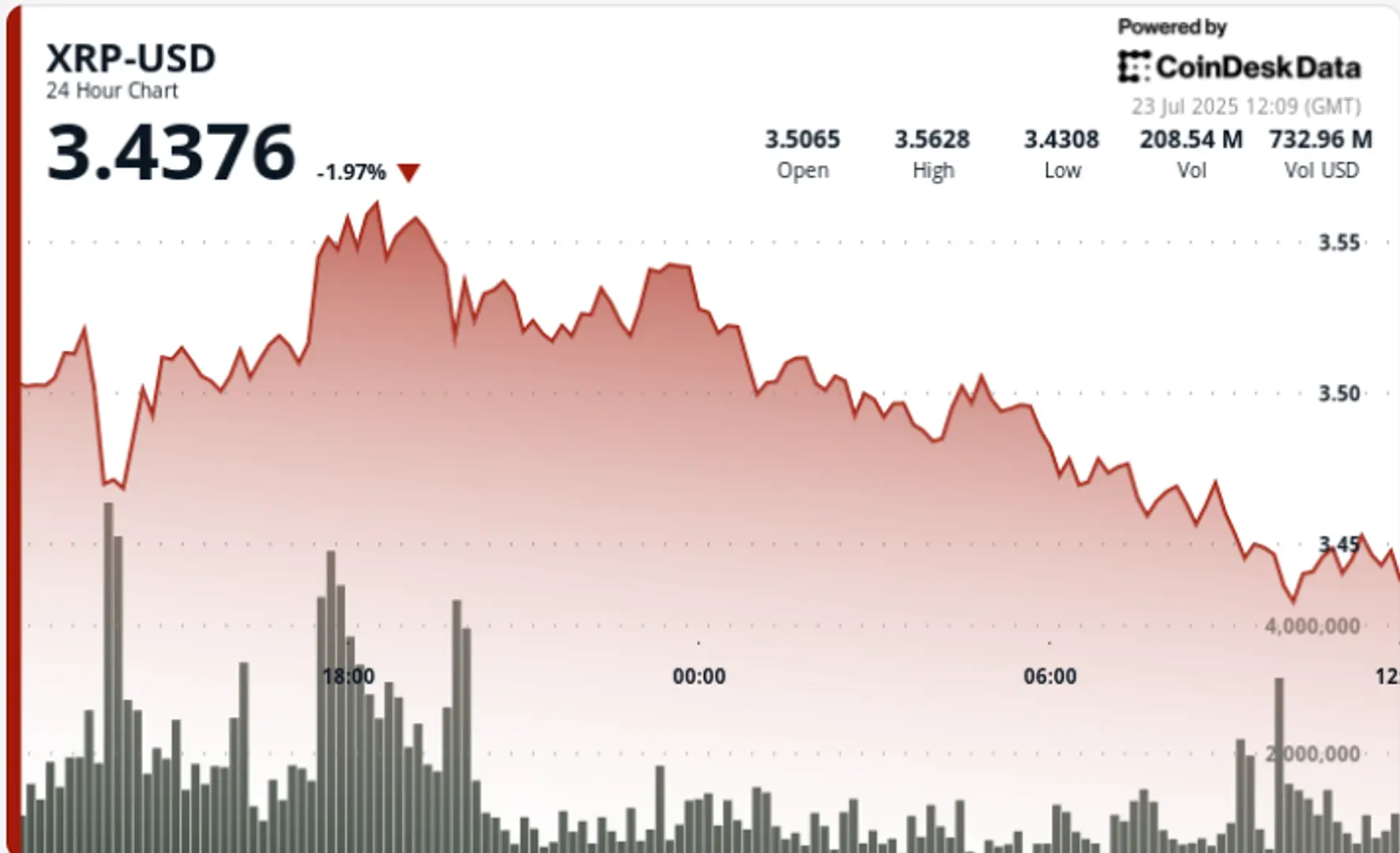

XRP traded in a wide $0.11 range between $3.46 and $3.57 during the 24-hour period ending July 23 at 08:00 GMT. The asset posted a 3% swing as bulls drove price to a session high of $3.57 on 106.4 million volume, before profit-taking triggered a reversal back to $3.46.

The late decline broke key support at $3.50, which had been retested multiple times overnight.

Volume surged as institutional flows reacted to a confluence of catalysts: advancing U.S. crypto legislation, fresh ETF approvals, and long-awaited technical pattern completion. Analysts still point to $6–$15 price targets long term, but warn of short-term consolidation risk.

News Background

• XRP broke above $3.65 last week, completing a six-year symmetrical triangle.

• ProShares launched the first XRP futures ETF, marking a milestone in regulated institutional access.

• U.S. Congress advanced the GENIUS and CLARITY Acts, pushing forward crypto regulation clarity, fueling fund flows into large-cap digital assets.

Price Action Summary

📖 Related Reading

- 📰 Crypto Daybook Americas: Institutions Pile In Amid ‘High Conviction’ That Prices Will Grind Higher

- 📰 Asia Morning Briefing: Risk of Escalating Israel-Iran Conflict Keeps BTC Around 105K Says QCP

The most aggressive move came at 17:00 GMT on July 22, when XRP jumped from $3.52 to $3.56 in under an hour on 106.4 million volume—over 50% above the daily average of 70.1 million. Resistance formed at the $3.56–$3.57 zone, capping upside and triggering a steady retreat through the overnight session.

The final hour (07:10–08:09 GMT) saw a breakdown from $3.47 to $3.46, as volume spiked to 2.5 million between 07:37 and 07:49. That move cracked the previously firm $3.49–$3.51 support band, confirming a short-term trend shift as selling overwhelmed buyers.

Technical Analysis

• 24-hour trading range: $3.46–$3.57 (3.18%)

• Bullish breakout at 17:00 July 22: $3.52 → $3.56 on 106.4M volume

• Support zone: $3.49–$3.51 tested multiple times overnight, failed by session close

• Resistance zone: $3.56–$3.57 capped rally, now defining next breakout point

• Breakdown confirmation: $3.47 → $3.46 on 2.5M volume spike

• RSI neutral; MACD turning lower — signals likely consolidation before next directional move

What Traders Are Watching

Institutional participation remains elevated amid ETF inflows and improving regulatory optics. Despite the near-term rejection at $3.57, analysts continue to flag bullish setups targeting $6.00 and even $15.00 over multi-month timeframes. The $3.50 level now acts as psychological pivot for bulls to defend in upcoming sessions.

🔗 You Might Also Be Interested In

Crypto Daybook Americas: Institutions Pile In Amid ‘High Conviction’ That Prices Will Grind Higher

Asia Morning Briefing: Risk of Escalating Israel-Iran Conflict Keeps BTC Around 105K Says QCP

Crypto Daybook Americas: Bitcoin Holds Above $100K as Iran, Israel Trade Blows

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!