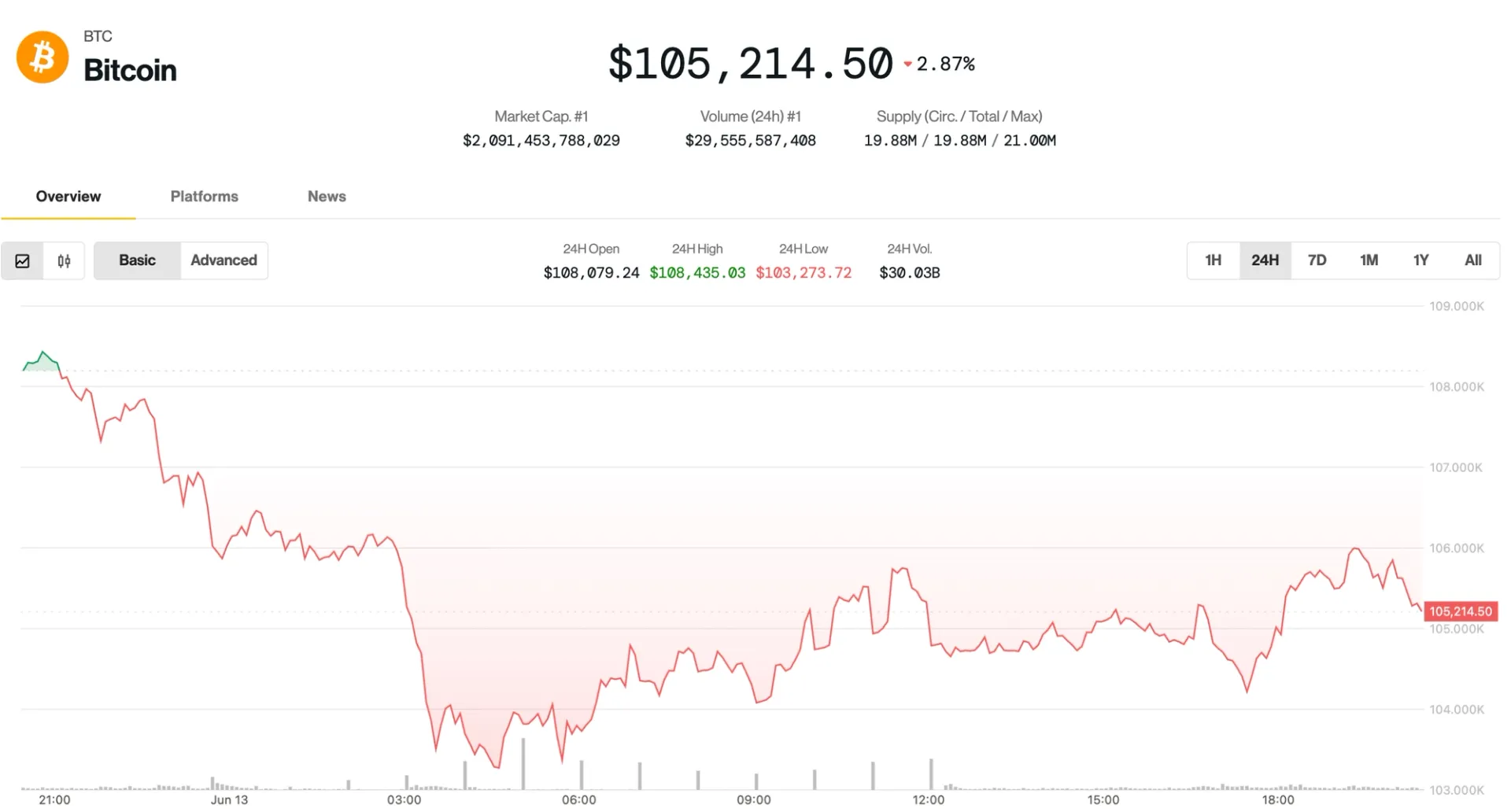

The crypto market is slightly bouncing back from early Friday’s jitters on escalating conflict between Israel and Iran.

After slumping to the $102,600 mark, bitcoin BTC rebounded to around $106,000 before fading lower in the U.S. afternoon hours with reports about a fresh wave of airstrikes targeting Iran. The top cryptocurrency was down 1.6% in the last 24 hours, changing hands at $105,200 and still less than 6% shy of its all-time high price.

Meanwhile, the CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding memecoins, stablecoins and exchange coins — has lost 4.4% in the same period of time. Tokens such as ether ETH, avalanche AVAX and toncoin TON were the hardest hit, slumping between 6% and 8%.

Crypto stocks, however, aren’t doing too hot. Most equities are in the red, especially bitcoin miners MARA Holdings (MARA) and Riot Platforms (RIOT), down 5% and 4% respectively. A notable exception is stablecoin issuer Circle (CIRCL), which is still benefiting from the windfall of its recent IPO; the stock is up 13% today, with news of retail giants Amazon and Walmart reportedly exploring stablecoins adding to the momentum.

Traditional markets don’t seem overwhelmingly concerned by the war. While gold is up 1.3%, potentially gearing up for new all-time highs, the S&P 500 and Nasdaq are only down 0.4% each.

What’s next for bitcoin?

“Nice bounce thus far and lack of follow-through lower,” well-followed crypto trader Skew said in a Friday X post. Market participants will likely remain cautious through the weekend with BTC tightly correlated with traditional markets amid heightened geopolitical risks, Skew added.

📖 Related Reading

- 📰 Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

- 📰 Crypto Daybook Americas: Bitcoin Drops as Mideast Tensions Rise, but $200K Still In Play

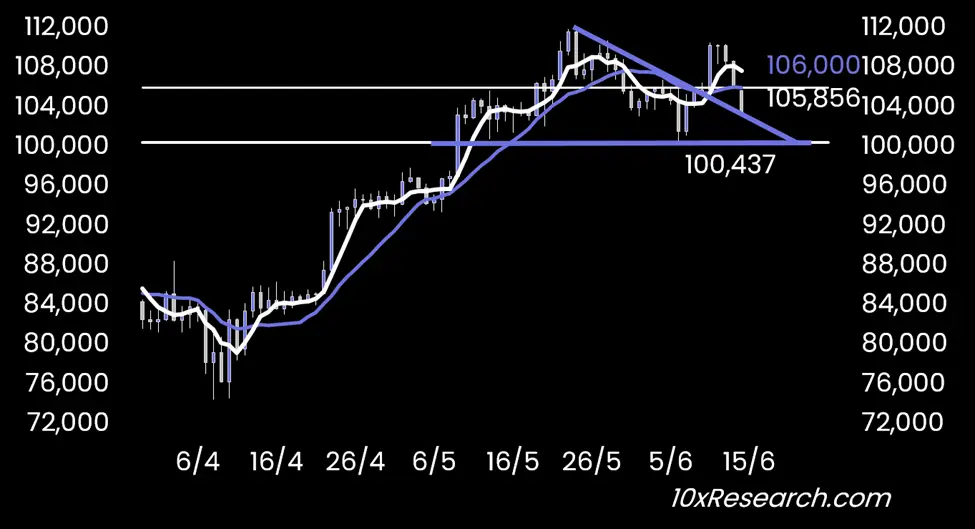

On the longer timeframe, some analysts see risks of a deeper pullback.

10x Research founder Markus Thielen noted that BTC’s drop below $106,000 translates to a failed breakout, and traders should wait for more favorable setups before rushing to buy the dip.

He highlighted the $100,000-$101,000 zone as key support, warning that a break below could mark a return to the broader consolidation phase similar to last summer.

John Glover, chief investment officer at bitcoin lender Ledn, argued that bitcoin entered a corrective phase from its record highs that could see the largest digital asset drop to $88,000-$93,000.

He said the $90,000 level could offer a favorable entry for opportunistic investors before BTC resumes its uptrend.

“Once this pattern has played out, the next move higher to the $130,000 area is expected to begin,” he said.

🔗 You Might Also Be Interested In

Asia Morning Briefing: BTC Slips Below $110K as ‘Signs of Fatigue’ Emerging

Crypto Daybook Americas: Bitcoin Drops as Mideast Tensions Rise, but $200K Still In Play

TON Surges 2.7% on Massive Volume Before Sharp Reversal

💡 Stay updated with the latest cryptocurrency news and insights by following our website! 🔔 Bookmark this site to get first-hand blockchain and digital currency news!